“Bundled” Plan vs. “Unbundled” Plan

All health plans utilize the same underlying principles to build out the functions needed to protect you financially and provide your employees access to healthcare. The degree of flexibility, control, and engagement will vary greatly depending on the method you choose for your company. There are benefits and to bundling all services with one provider; however, the advantages of unbundling your plan to utilize the highest value partners for each service can deliver lower costs and more control for your company and your employees thereby driving greater engagement and retention.

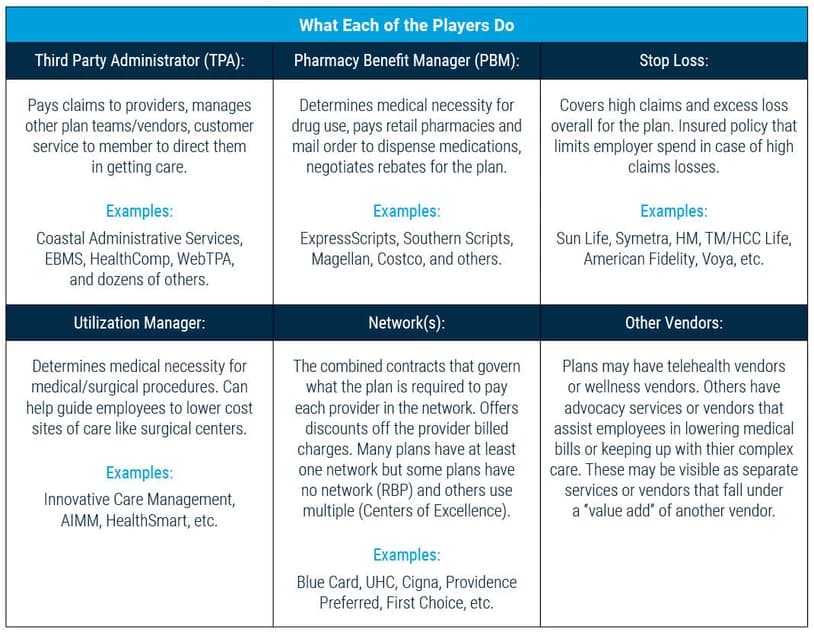

Parts of a health plan

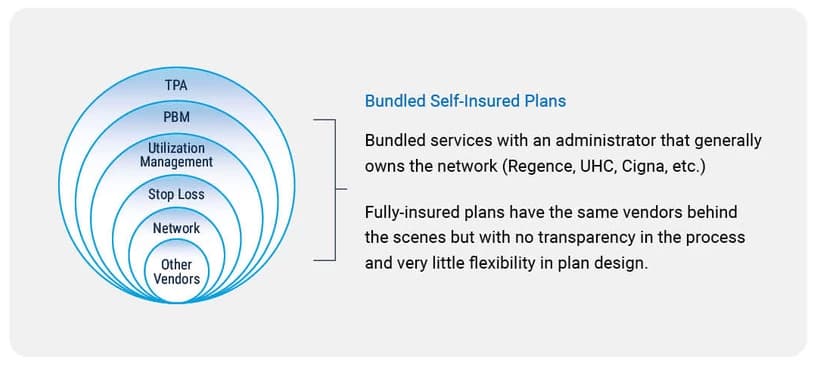

When a plan is either fully-insured or “bundled” with a third party administrator that selects and requires the plan to use their vendor partners, the pieces of your medical and pharmacy plan below are operating in the background with almost no coordination from you required.

FULLY-INSURED PLANS

Fully-insured offers the most simple and easy to understand option for employers. The insurance company provides all parts of the health plan for a set price and product. Fully insured plans offer little in the way of flexibility or transparency but typically provide the greatest “brand” recognition, community-based marketing, and perceived security.

BUNDLED SELF-INSURED PLANS

Bundled Self-Insured arrangements are generally offered by the same insurance carriers that offer fully insured plans. This can be a good way to get additional transparency and control while utilizing a “turn-key” product. The carriers (Regence, Cigna, UHC, Aetna) that offer these products generally own their own provider network and provide all the necessary pieces to the health plan.

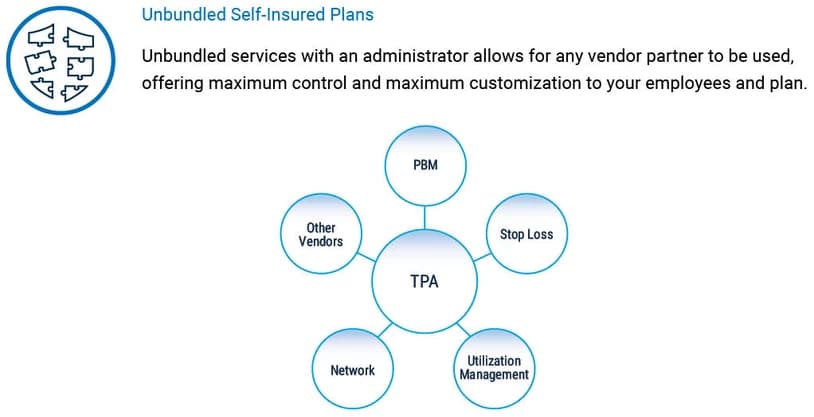

UNBUNDLED SELF-INSURED PLANS

Unbundled services with an administrator allows for any vendor partner to be used, offering maximum control and maximum customization to your employees and plan.

The unbundled model allows you as the employer to make endless choices for the inner workings of your plan:

- Choose a pharmacy benefit manager that assists employees in qualifying for manufacturer’s assistance – saving the plan thousands of dollars and getting needed medications right to an employee’s home address.

- Select a utilization manager or advocacy vendor that actively reaches out to members to help them get appointments at local surgical centers – saving the employee on high out of pockets costs, saving the plan on high hospital bills, and investing in local providers with high quality outcomes for long-term health of your employees.

- Utilize multiple networks for employees in different areas of the country, customizing the plan to meet different employee needs and the value of networks in differing areas of the country and world.

- Carve certain high dollar costs from the plan like infusion therapy and/or dialysis and use a specialty vendor to negotiate those prices on an individual case basis.

How can I unbundle?

Unbundled plans offer maximum flexibility and the greatest control of your healthcare spend, but they can also be complicated with more vendors to evaluate, more contracts to review, and more invoices to pay. We will help you partner with high value vendors that are accountable to your plan with tailored services that drive your costs down and quality of care up. RiskPoint provides tailored guidance as you build a high performing health plan pivotal for your population and financial goals. Want to share this information with your team? Download the PDF.

Contact Mandi or Matt today to show you how to achieve more control, 20% savings, and freedom to negotiate services that drive down costs, and quality of care up.

Mandi Roney

971.282.4492

Email

Matt Davis

971.282.4306

Email